New Legislation is in effect to move government and nursing home pension plans to well-established shared risk models.

Legislation passed on December 13, 2023 aims to provide long-term sustainability of pension benefits and ensure security, affordability and consistent retirement benefits across all government pension plans.

We have a responsibility to ensure government and nursing home employees have comparable pension plans that have enough money in them to continue to pay them in retirement.

In the short term, the legislation will affect about 7,850 active members in five plans and will allow another 2,500 part-time employees to participate in a pension plan, subject to eligibility requirements.

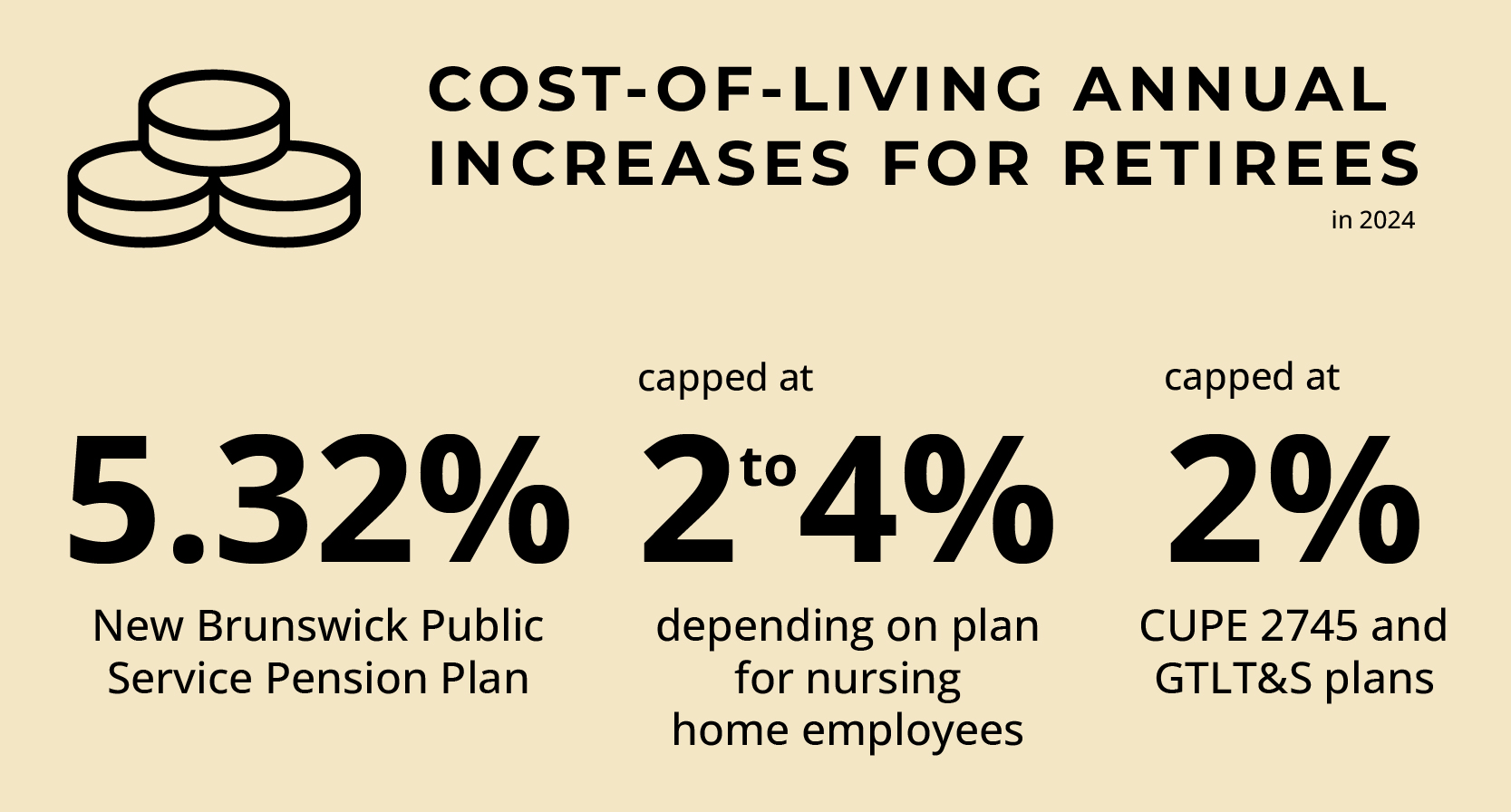

Employees in these plans are missing out on the benefits that GNB shared-risk pension members are receiving, including cost of living increases.

With the new legislation, pensionable service earned will be preserved. All current plan members will continue to contribute to and be paid under their existing plan until the time of transfer.

Current beneficiaries will receive the same monthly pension payment under the terms of their existing plans, up until transfer, after which the payments will be subject to adjustments under the terms of the existing shared-risk plan.

The transfer process timeline under the new legislation began on February 1, 2024.

Please note:

- Employees will not lose the pension benefits they have earned.

- Retirees will continue to receive their monthly pension payment.

Two CUPE school district pension plans

- Pension Plan for General Labour, Trades and Services Employees (GLT&S)

- Pension Plan for Full-Time CUPE 2745 of NB School Districts (CUPE 2745)

These two plans for CUPE 1253 and CUPE 2745 employees (bus, drivers, custodians, maintenance workers, administrative support, and educational assistants) currently have a deficit of approximately $162 million that will continue to increase without significant plan reform.

Three Nursing Home Employee Pension Plans

- The Pension Plan for General and Service Employees of New Brunswick Nursing Homes

- The Pension Plan for Nursing and Paramedical Employees of New Brunswick Nursing Homes

- The Pension Plan for Management Employees of New Brunswick Nursing Homes

Government has put in over $55 million in extra funding into these three nursing home plans since 2008. The deficit for the Pension Plan for General and Service Employees of New Brunswick Nursing Homes is approximately $123.4 million.

(Information is not currently available to the public. Improving transparency is one of the objectives of the reforms.)

Over the years, government has made ongoing attempts to negotiate reforms on this matter through the collective bargaining process. Prior to moving forward with legislation, government asked CUPE representing the two school district pension plans to agree to transfer their pension plans to an existing New Brunswick shared-risk plan, which have been performing well, are fully funded and offer enhanced benefits like cost-of-living annual increases for retirees.

The Pension Plan Sustainability and Transfer Act establishes a process and framework to provide for the transfer of designated pension plans into an established shared-risk pension plan registered under Part II of the New Brunswick Pension Benefits Act.

The purpose of the act is to improve the sustainability, affordability and security of pension benefits and provide for pension plan arrangements that are consistent with pension plan arrangements offered across the public service.

Key elements of the act include:

- A memorandum of understanding that is intended to allow parties to the affected pension plan to negotiate the employment related aspects of the transfer including the selection of the intended receiving plan.

- A transfer agreement to be negotiated between the administrator of the affected pension plan and the administrator of the receiving shared-risk plan to provide for the matters pertaining to the transfer.

- Established timelines throughout the process to facilitate the conclusion of the transfer of the affected plans with the possibility of extensions if necessary.

- Appointment of a sustainable pension plan authority, an individual appointed by Lieutenant Governor in Council, to act as a mediator or arbitrator should the parties in any part of the legislative process be unable to come to agreement on any, or all, applicable matters related to the memorandum of understanding or the transfer agreement.

The goal with the legislation, is to move these pension plans into a larger well-established shared-risk pension plan administered within New Brunswick. This will ensure current retirees and those still working have a sustainable pension in the future.

A plan that’s fair for taxpayers and employees

The bottom line for government is fairness and sustainability.

Download the PDFIf you have questions about existing public service shared risk pension plans in New Brunswick, contact Vestcor. Vestcor has been administering shared risk plans since their inception. They will be happy to answer any questions you may have about shared risk plans. Please submit your questions to: [email protected] or [email protected] or call 1-800-561-4012.