In the new structure there are 89 entities:

- 77 local governments

- 12 rural districts

What is a local government?

A local government is an incorporated entity that provides services and makes decisions on local matters for a defined geographic community. Each local government has a council comprised of a mayor and councillors who are elected through a general municipal election every four years.

What is a rural district?

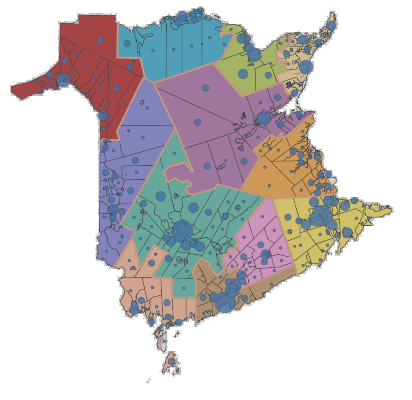

A rural district is a new structure for New Brunswick that brings together former local service districts (LSD)— or parts of them—that are outside local government boundaries. Rural districts are unincorporated areas that are sparsely populated. As of January 1st, 2023, there is one rural district in each of New Brunswick’s 12 regions.

All local governments and rural districts are represented on the regional service commission board of directors.

The last comprehensive overhaul of New Brunswick’s local governance system occurred in 1966-67. The reforms, introduced as part of the Equal Opportunity Program, were largely based on the findings and recommendations of the 1963 Royal Commission on Finance and Municipal Taxation in New Brunswick, often referred to as the “Byrne Report”. The most significant changes to the local governance system at the time included the following:

Service responsibilities were realigned between the provincial and local governments. Services such as education, health, social welfare and the administration of justice became the complete responsibility of the provincial government. Local services such as fire protection, roads and streets, police protection, parks and recreation, local planning and development would be looked after by local governments.

A revamped property tax system was introduced to support the new provincial and local service responsibilities and the new structure. This included the introduction of the provincial property tax ($1.50 per $100 of assessment); the centralization of the assessment, billing and collection functions.

County municipalities were eliminated and replaced by LSDs. Many small communities were incorporated as villages and existing towns and cities remained in place.

The unconditional grant system for local governments and LSDs was introduced to help ensure that residents could receive a comparable level of services at reasonable property tax rates.

The Municipalities Act was enacted that would set the administrative and governance framework for municipalities and local service districts.

More than 50 years after being implemented, these changes still form the basis of our local governance system. However, many adjustments to the local governance system, large and small, have been made during this time in response to the various issues that have arisen.

- 1966-67 – Equal Opportunity reforms, largely based on Byrne Commission recommendations, implemented.

- 1975-78 – Provincial property tax on owner-occupied residential properties (homeowners) gradually eliminated.

- 1978-79 – Special provincial property tax rate on owner-occupied residential property in LSDs introduced.

- 1982 – Business assessment tax was replaced with a non-residential property tax.

- 1985-97 – Solid Waste Commissions were established.

- 1995 – The first rural community was established.

- 1992-98 – The strengthening urban centres initiative, resulting in some consolidation of local governments and LSDs, along with regionalization of some services in a few areas, took place.

- 2003 – A significant number of administrative amendments were made to the Municipalities Act.

- 2005 – Changes to rural community model enacted that would allow for local governments and/or LSDs to restructure together.

- 2013 – The 12 Regional Service Commissions were created.

- 2013 – The Community Funding Act was adopted, replacing the Municipal Assistance Act. The Unconditional grant program was eliminated and replaced by the Community Funding and Equalization Grant.

- 2013-16 – Implementation of Improving New Brunswick’s property tax system: A white paper, recommendations.

- 2018 – The Local Governance Act was adopted, replacing the Municipalities Act, to bring New Brunswick’s legislation in line with other Canadian jurisdictions.