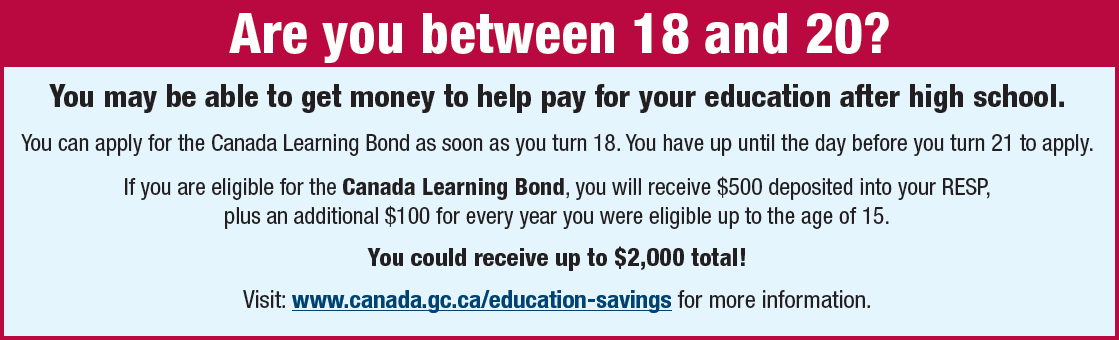

The Canada Learning Bond (CLB) helps children from families with low-income, or children in care, pay for the future costs of full- or part-time studies after high school, whether in a trade program, college or university. For those eligible, the Government of Canada provides between $500 and $2,000 for education-related expenses after high school into a Registered Education Savings Plan (RESP). Most importantly, no contributions into an RESP are required to receive the CLB.

Starting in January 2022, approximately 148,000 young people between the ages of 18 and 20 will be eligible for an average of $1,300 in unclaimed CLB. The process for them to access the funds is clear, but awareness is low. All that would be required to access these monies would be to open an RESP. By applying for the CLB, these young adults can take a step to finance their own post-secondary education, and set themselves up for better careers, and a brighter future.